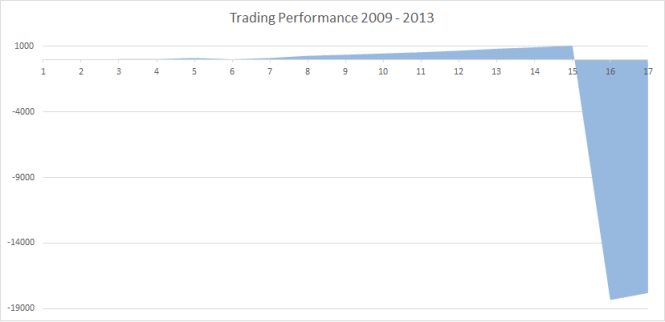

So, I traded 6 times in 2016, although I did not close 3 of the trades until 2017. From this 6 trades, I made a small gain of 286.29 and reduce my all time trading loss to (29071.61). I also managed to bring my trading loss to an all time high of (31976.73) before recovering a little.

So, I traded 6 times in 2016, although I did not close 3 of the trades until 2017. From this 6 trades, I made a small gain of 286.29 and reduce my all time trading loss to (29071.61). I also managed to bring my trading loss to an all time high of (31976.73) before recovering a little.

I get my motivation back after I made some gains in the first two trades, alas it was short-lived. I get into 4 more trades and not long after that, on 25 April 2016, 1MDB rear its ugly head again. What happened after was only 1 way down. Instead of cutting my losses, I got fed up and turned a blind eye toward my own trading. Then I ran away. With my trading still in open position. Not a clever move.

For 2016, these were the lesson I got.

- Never learn from my pass lesson – I kept on repeating the same mistakes where I let my losses grow bigger and did not take any action to cut it early.

- Blaming everything else – I blamed everything else when things did not go the way I wanted. It was still hard for me to admit my mistakes and losses.

- Close position first – If you want to run away, at least close your position first.

So, I managed to burn another significant hole in my pocket in 2014. I traded 5 counters, losing 11247.26 and brought my overall trading lost to

So, I managed to burn another significant hole in my pocket in 2014. I traded 5 counters, losing 11247.26 and brought my overall trading lost to